Investment to Accelerate Irth’s Growth and Customer Value

SAN FRANCISCO & COLUMBUS, Ohio – August 26, 2025 – Irth Solutions (“Irth”), a leading provider of enterprise software for critical energy and infrastructure companies, today announced that it has entered into a definitive agreement to be acquired by TPG, a leading global alternative asset management firm. TPG will acquire Irth through TPG Growth, the firm’s middle market and growth equity platform, from Blackstone Energy Transition Partners (“Blackstone”).

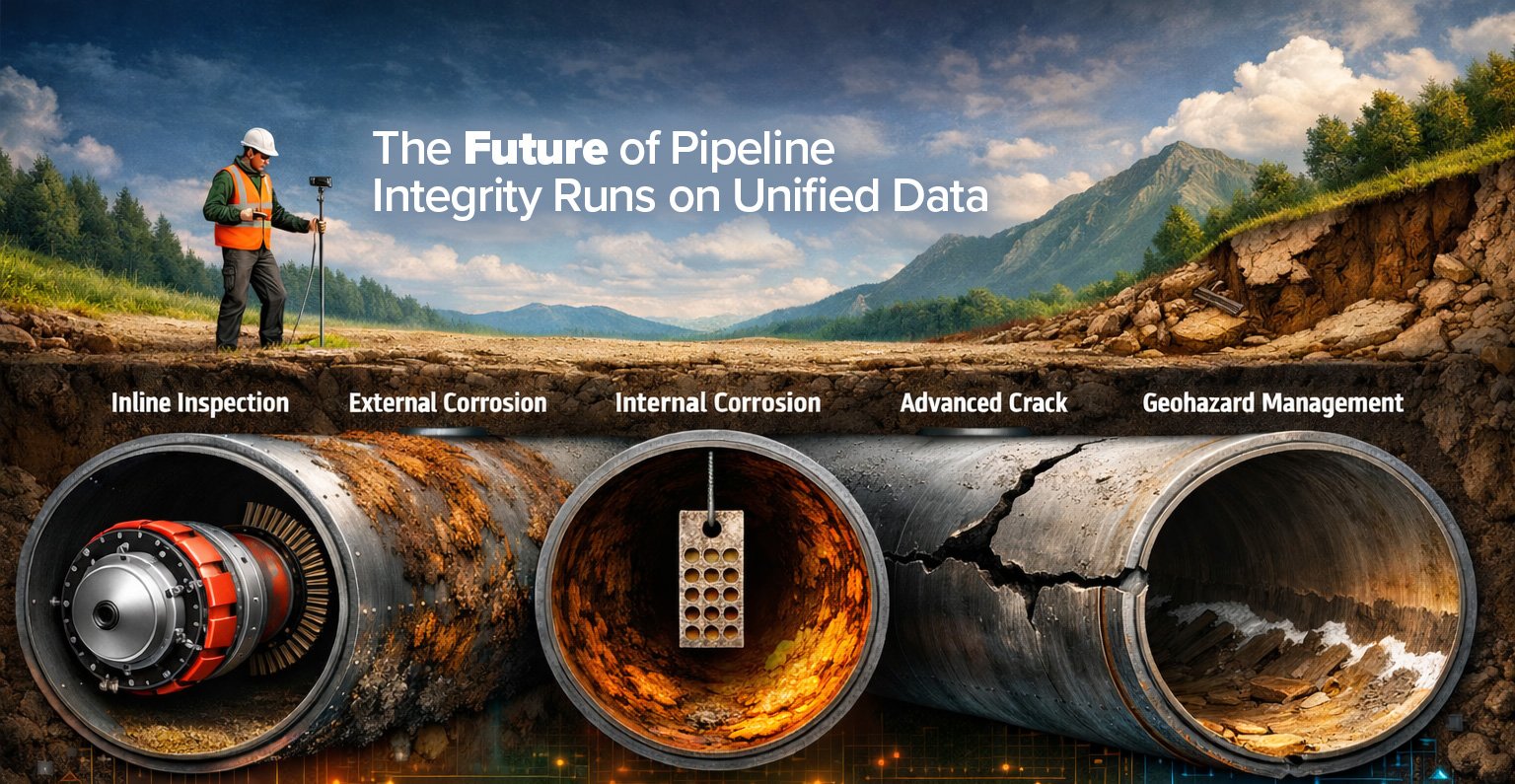

Founded in 1985, Irth provides cloud-based software solutions that integrate geospatial data with business intelligence and AI to offer 360-degree situational awareness for infrastructure operators, enabling proactive risk identification, mitigation, and management. Irth’s mission-critical solutions protect the assets of some of the nation’s largest energy, utility, and telecommunications providers, ensuring the safe and reliable delivery of essential services. Its platform serves more than 20,000 daily users, processing more than 130 million work orders and 500 million AI insights annually to detect emerging weaknesses and enable prompt resolutions and proactive interventions that keep critical network infrastructure operational.

“With TPG’s support and extensive software, AI, and infrastructure expertise, we are confident they are the right partner to support our next chapter,” said Brad Gammons, CEO of Irth. “This partnership strengthens our ability to deliver even greater value to the energy, utility, and telecommunications providers we serve. We look forward to building on the success we achieved with Blackstone and working with TPG to accelerate innovation to help our customers strengthen resilience, improve reliability, and navigate the rapidly evolving risks they face each day.”

“Energy and utilities companies face constant pressure to deliver services safely, sustainably, and without interruption for millions each day,” said Aaron Matto, Business Unit Partner at TPG. “Irth’s cloud-based, AI-enabled solutions have proved essential to energy and utility providers in navigating mounting risks by offering data and actionable insights to spot and resolve weaknesses before they escalate and to prevent damages before they occur. TPG has invested behind mission-critical, purpose-built software businesses for decades, and we are excited to partner with Brad and the team to support the continued growth of a company that keeps our infrastructure secure and the world connected.”

“We have been proud to partner with Brad and the entire Irth team since 2021, supporting its continued growth as it serves the ever increasing need for investment, resiliency, and digitalization of critical energy and infrastructure assets,” said Bilal Khan, a Senior Managing Director, and Alex Lue, a Managing Director, at Blackstone. “We look forward to Irth’s continued success with TPG under Brad’s leadership moving forward.”

The transaction is subject to customary closing conditions and is expected to close in late 2025.

Terms of the transaction were not disclosed.

Advisors

Evercore is serving as lead sellside advisor to Blackstone and Irth Solutions, and Lazard is also serving as an advisor. Kirkland & Ellis is serving as legal advisor to Blackstone and Irth Solutions. Cantor Fitzgerald and Lincoln International are serving as financial advisors to TPG, and Weil, Gotshal & Manges LLP is serving as legal counsel.

About Irth

Irth, headquartered in Columbus, Ohio, provides enterprise software solutions for critical network infrastructure. It blends geospatial data with business intelligence and AI to offer 360-degree situational awareness. For over 30 years, Irth has served critical infrastructure operators, helping them manage damages, mitigate risk, manage compliance, and optimize asset performance through data-driven insights.

About TPG

TPG is a leading global alternative asset management firm, founded in San Francisco in 1992, with $261 billion of assets under management and investment and operational teams around the world. TPG invests across abroadly diversified set of strategies, including private equity, impact, credit, real estate, and market solutions, and our unique strategy is driven by collaboration, innovation, and inclusion. Our teams combine deep product and sector experience with broad capabilities and expertise to develop differentiated insights and add value for our fund investors, portfolio companies, management teams, and communities.

Contacts

Irth

Joshua Fuller

jfuller@irthsolutions.com

TPG

Julia Sottosanti

media@tpg.com

Blackstone

Jennifer Heath

jennifer.heath@blackstone.com